What is the Chinese Motivation in Zimbabwe?

Introduction – why is Eddie Cross’s article so relevant?

The article below by Eddie Cross published in December 2024 on his website https://www.eddiecross.africanherd.com is very appropriate to the current economic situation in Zimbabwe and is presented below in its original form, although the website author added the background section, some notes and photographs.

Background

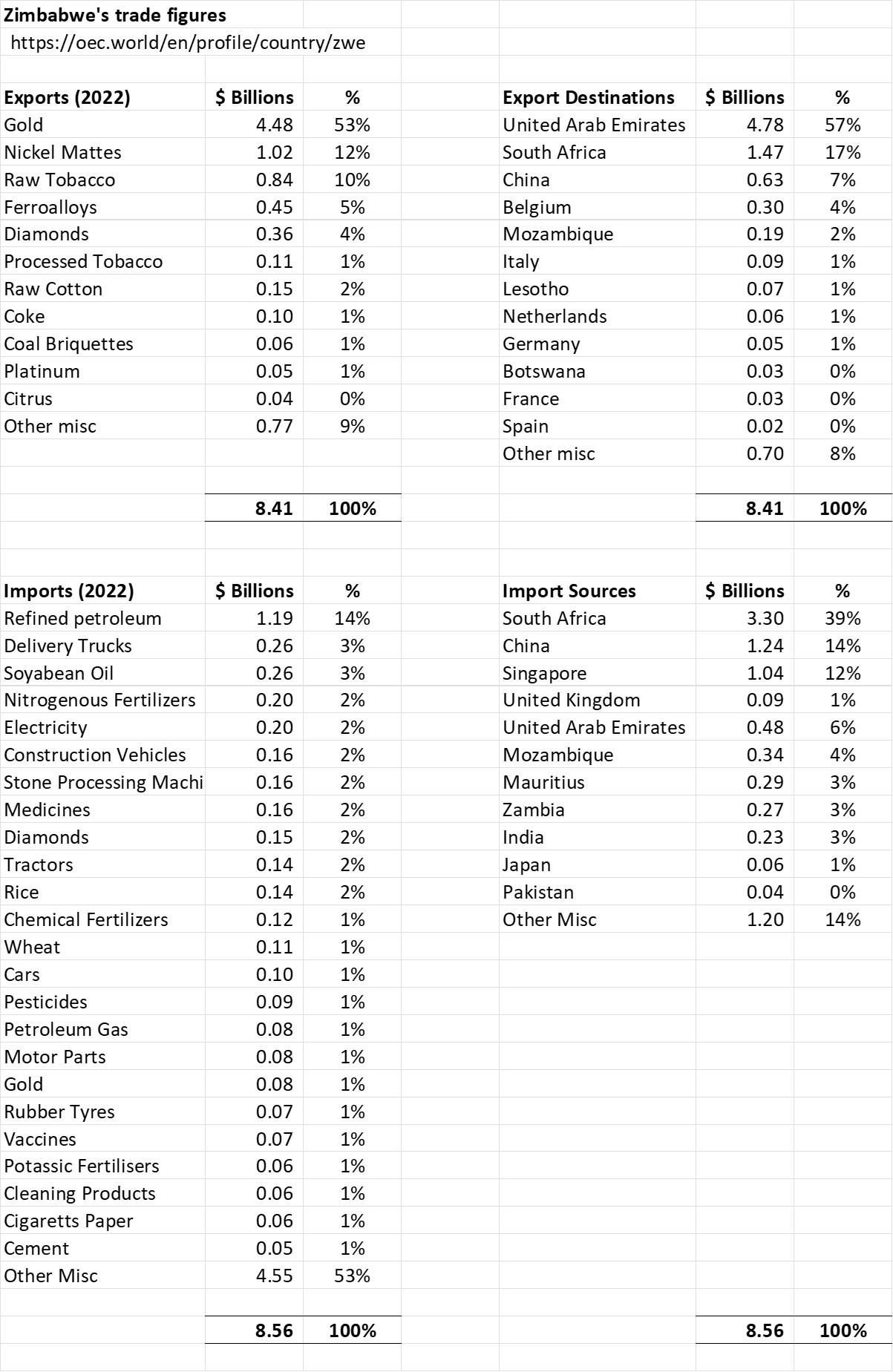

Marko Phiri in an article[1] states that as far as trade is concerned the Chinese have been Zimbabwe’s favourite partner for years. They account for the largest proportion of exports[2] and they are the largest investors in Zimbabwe.[3]

Jevans Nyabiage: Chinese and local workers in Zimbabwe’s mining industry

In 2021 Zimbabwe’s information minister Monica Mutsvangwa[4] said the country had resolved to “offer itself as the foreign direct investment destination of choice to Chinese entrepreneurs.”

Mutsvangwa added that the government was easing red tape to allow further entry of Chinese investors into Zimbabwe, “Bureaucracy and red tape are being done away with. Recently the President launched the One-Stop Zimbabwe Investment Development Authority to expedite business decisions and speed commitment of investment funds. This will be a boon to Chinese risky capital…More FDI is anticipated from the new and growing business class of China and its crop of global billionaires.”

Local experts expressed concern, Albert Makochekwana, an Economics Professor at the University of Zimbabwe said, “Government procurement policies do not support local producers. You see for instance government departments and parastatals buying most goods from other countries.

The government pronouncement should [tell people to] strictly be buying local, but our local suppliers’ prices are just out of this world.”

Makochekwana told The China Project[5] that there were long-standing concerns about cheap Chinese products flooding local markets and the Minister’s statement was unlikely to be met with any enthusiasm from local companies.

Nathan Hayes, an analyst at the Economist Intelligence Unit said, “In many countries, governments seek to manage such investment inflows in accordance with national development strategy, but countries like Zimbabwe struggle to attract many investors due to a very poor business environment, and ongoing economic and political crises make it more difficult…Zimbabwe could benefit from more structural external assistance, with investment across the supply chain. Most inputs and equipment are imported, making it expensive, while the government has a limited supply of hard currency to pay for imports.”[6]

Marko Phiri’s concluding remark was that with Minister Mutsvangwa expressing the government’s commitment to granting China more business opportunities, it could be some time before local businesses turn the corner and help rebuild Zimbabwe’s battered economy.

Eddie Cross’s article only mentions corruption in a roundabout way saying, “Our old Army Generals all benefitted greatly.” Corruption has been a serious problem for a long-time with ZANU-PF officials and government bureaucrats actively involved in cahoots with Chinese investors. Corruption is deeply embedded in Zimbabwe’s economy amongst the ruling elite, civil service, and armed forces.[7]

Eddie Cross’s article from his website dated December 2024

I was astonished to hear the other day that there are now over 85 000 Chinese nationals living in Zimbabwe.[8] I questioned this estimate and was told no, it is real. What on earth are they doing here? They are not migrants; they all want to go home eventually. Many have their families back in China and go back regularly. They are here to work. Why?

Then it dawned on me, we are the new Australia. They have targeted us for raw materials for the industrial monster at home. We have lots of targets - the largest iron ore deposits in the world, plenty of limestone and coal so we can make steel. They need to move steel production away from China to avoid US and European trade restrictions and to move dirty, polluting industry to the pristine blue skies of Africa.

We have the best Chrome deposits in the world, 9 billion tonnes of it worth a conservative US$100 trillion.[9] We have enormous Lithium reserves[10] and they are loaded with other critical minerals that are in fact worth more than the Lithium and we do not understand what that means. We applaud them because shortly we will be exporting 5 million tonnes of lithium concentrate a year to China, worth perhaps US$4 billion in new export earnings, four times our famous tobacco crop, but missing the fact that it might contain other metals and minerals worth many times more.

VoA: The notorious Sino Africa Huijin mine in Penhalonga, Manicaland Province

A quarter of our gold output goes to China and we have no idea about how they are doing that or what is involved, but the evidence of open cast mining, large investments in milling and extracting machinery for the small-scale mining industry here which is among the most important in the world, is everywhere.[11] They ignore environmental regulations and leave behind a moonscape of countryside that looks like a World War 1 battlefield.[12]

They are exploiting our finest coal reserves for their smelters and steel production, even exporting their surplus.

It all started when we discovered the Marange diamond fields and they joined forces with our old army generals and created a company that was eventually responsible for 80 per cent of the production of raw diamonds there. I estimate that US$30 billion in raw diamonds has been produced between 2008 and today. At one stage we were larger than Botswana as a diamond producing State.[13]

The Chinese company that was involved was a tiny, rural corporation in China, owned by the Red Army. Today it is a multinational corporation with a whole bevy of top-class hotels, a private Jet, and headquarters for Africa in Mozambique. Our old Army Generals all benefitted greatly, just look at the homes many of them have built in this country, the physical evidence of Chinese owned real estate in Harare is everywhere. The people of Marange still wallow in poverty and the active diamond fields do not have a single kilometre of tarred road although they have an international standard airport which can receive large aircraft to fly product out and bring people and equipment in.[14]

Google Earth Pro: Marange diamond fields showing the processing plant and airfield

In the field of infrastructure to support all these large-scale investments, Chinese activity is focused totally on what they need to achieve their goals here. Power, water, railways, even Port capacity. Just to give you some idea of the scale of what they have in mind they plan an artificial Port on the coast of Mozambique capable of handling 200 million tonnes of cargo annually. That is four times the capacity of Maputo.[15]

What concerns me, is that none of this activity has any application to the needs of Zimbabwe. When I investigated the Marange diamond fields in 2012, as a Member of Parliament, I was able, with relative ease, to get the production information I needed for 5 of the 6 mining companies involved. Why, because they all employed Zimbabweans and I got daily output figures and even quality data (19 per cent Gemstone quality) and even sales data. The last remaining miner was Chinese owned and operated and they employed no Zimbabwean staff. To estimate what they were doing I had to look at US sourced satellite images which clearly showed what was going on below.

The benefit to Zimbabwe of this level of Chinese activity here is evident. They buy the majority of our tobacco, our ferrochrome exports run to tens of millions of dollars a year. Drive past Hwange Colliery, owned notionally by the Government, but in fact now largely a Chinese asset.[16] The smoke stacks of coke batteries belching into the atmosphere. The queues of heavy-duty trucks carrying coal to local and regional markets. The road north and south now smashed and barely usable.[17]

Lethokuhle Nkomo, The Standard Newspaper: broken roads at Hwange

There is little or no value addition except for the primary production phase.[18] There are no plans to invest in a Lithium refinery to produce a product suitable for use in the production of batteries. Even the steel plant is only producing steel billets for export to China for conversion into finished product. International sanctions may force them to produce steel for sale to manufacturers in the West but for the time being they are producing a product for export in primary form.

Right now, the decision by the Zimbabwe Government not to maintain power subsidies on electricity going to their furnaces, is forcing the Chinese companies to invest in coal-based power production.

They are doing so at a cost of US$600 000 per megawatt with the objective of meeting their own needs at about US$6 cents per Kilowatt, one third of the current ZESA tariff which is necessary because the new Chinese built power station at Hwange cost three times per Megawatt than what their own plant will cost. To achieve those sorts of outcome they will have to secure coal at rock bottom prices, while they supply ZESA at three times the cost.

This is a very concerning situation and the question for us as a nation, is what we do about it. First, we have to recognise, that unlike Australia where privately owned and operated mines for coal and iron ore, mine these products for sale to China at a market related price. Australia has therefore been one of the main beneficiaries of the Chinese expanding economy. Australian criticism of Chinese human and political rights has evoked a very strong response leading to the sort of activity we see here.

The Belt and Road initiatives in African and many other developing States almost always involve overpriced infrastructure which has to be financed on commercial terms.[19] Hwange Power Station is a prime example, the railway line in Kenya and Ethiopia is another example. In many respects the main reason for this is that the Western world has not been either active or supportive.

We in Zimbabwe need to recognise that China can be used to drive development but it must be on our terms. They must employ our people, their investments in infrastructure must serve out nation and not just their interests. We must get back full value of our exports to China. Our relationship with China must be carefully balanced, they must not be allowed to bribe our officials to secure benefits that are not in our national interests.

The rape and pillage of our resources for marginal results simply cannot be allowed to continue.

Eddie Cross

Harare, 29th December 2024

References

Enos Denhere. Chinese-owned gold mine stirs controversy in eastern Zimbabwe. 7 Jan 2025. https://www.voanews.com/a/chinese-owned-gold-mine-stirs-controversy-in-eastern-zimbabwe/7927141.html

Lethokuhle Nkomo. Mining activities, rains, destroy Hwange roads. The Standard Newspaper. 4 April 2021. https://www.thestandard.co.zw/2021/04/04/mining-activities-rains-destroy-hwange-roads

Marko Phiri. Chinese importers choke Zimbabwe manufacturers amid COVID-19. 15 Feb 2021.

http://thechinaproject.com/2021/02/15/chinese-importers-choke-zimbabwe-manufacturers-amid-covid-19/

Eric Olander and Cobus van Staden. Zimbabwe Environmental Law Association (ZELA) China to finance and build a massive new coal power plant in Zimbabwe. 27 May 2020. https://thechinaproject.com/podcast/china-to-finance-and-build-a-massive-new-coal-power-plant-in-zimbabwe/

New Zimbabwe Newspaper. Zimbabwe now accommodating 85,000 Chinese nationals exploiting resources under the guise of investments – Cross. 31 Dec 2024. https://www.newzimbabwe.com/zimbabwe-now-accommodating-85000-chinese-nationals-exploiting-resources-under-the-guise-of-investments-cross/

Global Witness. Where is Zimbabwe’s Diamond Money Going? 19 Dec 2014. https://www.globalwitness.org/en/blog/where-zimbabwes-diamond-money-going/

Notes

[1] Marko Phiri. Chinese importers choke Zimbabwe manufacturers amid COVID-19. 15 Feb 2021. https://thechinaproject.com/2021/02/15/chinese-importers-choke-zimbabwe-manufacturers-amid-covid-19/

[2] See the figures for Zimbabwe’s exports and imports in the Appendix below

[3] The Centre for Natural Resource Governance (CNRG) a Harare-based community rights organization issued a report in September 2024 stating Chinese investors control an estimated 90% of Zimbabwe’s mining industry. CNRG Executive Director Farai Maguwu posted on their website in September 2024 that Sino investments in Zimbabwe’s mining sector saw 121 investors contributing a staggering $2.79 billion in 2023.

[4] In 2025 Jenfan Muswere is the current Minister of Information, Publicity and Broadcasting Services and was replaced by. Monica Mutsvangwa Monica Mutsvangwa is now the Minister of Women Affairs, Community, Small and Medium Enterprises Development

[6] Marko Phiri. Chinese importers choke Zimbabwe manufacturers amid COVID-19. 15 Feb 2021. https://thechinaproject.com/2021/02/15/chinese-importers-choke-zimbabwe-manufacturers-amid-covid-19/

[7] CNRG Executive Director Farai Maguwu accused local lawmakers of corruption, saying, “Instead of enforcing the law, they are cashing in on this illegality by forcing them to close down, demanding bribes for reopening, and then returning to close them down again and demand another bribe…This cycle goes on and on while the environment is being sacrificed." (VoA report)

[8] The Zimbabwe Government strongly refutes this figure saying it is actually closer to 25,000 mostly employed in the mining industry. Wikipedia states 10,000 but this is surely incorrect.

[9] Zimbabwe’s chrome deposits are found in the Great Dyke and are high grade

[10] Zimbabwe has the largest known lithium reserves in Africa and is a global player after Chile, Australia, China, Argentina, and Brazil.

[11] The World Gold Council ranks Zimbabwe as the 22nd largest world gold producer (46.6 tons) but these are officially declared gold exports and ignore the bulk of gold exports which are illicit and smuggled mostly to Dubai

[12] Local Penhalonga residents say Sino Africa Huijin Holdings has caused severe environmental destruction and community harm. The company is accused of forging community signatures on their Environmental Impact Assessment document, raising questions about the transparency and legitimacy of their operations. These complaints caused the Ministry of Mines to shut down the mine’s operations twice in 2024, but they have resumed in the past two months. Traditional Chief James Kurauone of the Mutasa district told VOA on 11 Dec that officials forced Sino Africa Huijing's to stop operations because it, “failed to address critical concerns raised by the local community…These concerns that led to the temporary closure included severe air pollution, destructive blasting activities impacting local homes, and the company's failure to fulfil its corporate social responsibility obligations." (VoA: Chinese-owned gold mine stirs controversy in eastern Zimbabwe)

The Environmental Management Agency’s (EMA) Midlands Provincial Manager, Benson Besera, said Chinese companies are tearing down Zimbabwe’s environment, adding, “An influence of Chinese companies in Shurugwi has emerged as one of the biggest threats to the mining town’s infrastructure, livelihood of locals (mostly through ill treatment at workplaces by the Chinese employers) This was revealed in a Provincial Mining Indaba (PAMI) organised by various stakeholders which include Zimbabwe Coalition on Debt and Development (ZIMCODD) Environmental Management Agency (EMA) Zimbabwe Council of Churches (ZCC) Zimbabwe Environmental Law Association (ZELA) and Gweru City Council (GCC) (New Zimbabwe Newspaper article)

[13] Global Witness states that Zimbabwe was the sixth-largest diamond producer in 2014. They write, “Furthermore, little is known about where the money goes. In 2012, despite having been assured of minimum $600 million in diamond dividends, the Finance Minister reported that just $43 million had been delivered. At the end of 2013 a new Finance Minister announced that despite an expected $61 million, not so much as a cent materialised. This year, the Treasury predicted $96m but failed even to report what it received. In this case, no news is unlikely to be good news.”

[14] Zimbabwe benefited very little from the Marange diamond fields. A relevant article on this website is Marange Diamonds – Zimbabwe’s natural resource stolen from the nation under Manicaland Province on the website www.zimfieldguide.com

[15] About US$3 billion is to be invested in the construction of a coastal shipping port at Chongoene and connecting rail lines with the Limpopo Corridor and to the heavy sands of Chibuto, in Gaza province

[16] Another example is the construction of the Sengwa Power Station that the Zimbabwean government announced in April 2020. The 2,800-megawatt plant will be a joint effort between Zimbabwe’s Rio Energy and a consortium of Chinese state-owned enterprises led by the Wuhan-based infrastructure contracting giant China Gezhouba Group. Gezhouba will be the lead contractor and will also be responsible for raising additional capital. Separately, Power China will build a 150-mile-long water pipeline for the plant along with transmission lines. The Industrial and Commercial Bank of China will be involved in financing, and Sinosure is already on board to provide risk insurance. Note the low participation of the project construction by Zimbabwean companies!

[17] The condition of the road past Hwange is so bad that one cannot tell if the road is still tarred or not. The once tarred road is just now black because of coal pebbles that are regularly dropped by speeding haulage trucks going to Hwange Thermal Station daily. It used to take only 30 minutes to drive to the Zambezi River from Hwange, but on this dusty black road with potholes, motorists now take one hour and 30 minutes or more.

Local residents blame mining activities on the periphery of Hwange town for also destroying the Zambezi-Deka road, cutting off the road network that links villages to the mining town. (Lethokuhle Nkomo article in The Standard Newspaper)

[18] In addition to this criticism of Chinese investors there are other governance factors that hinder Zimbabwe’s economic growth and benefits to communities due to poor safety standards, unsafe working condition, unfair displacement measures, environmental damage and low wages for the workers.

[19] Large loans for all these infrastructure projects are lent at commercial rates of interest. See the article Zimbabwe in the sights of China’s debt-trap diplomacy under Harare on the website www.zimfieldguide.com